Gold has a special position in India. Whether it's a family heirloom, hand-me-down from multiple generations, or an investment sitting idle for the proverbial rainy day, gold has been a part of our financial and emotional fabric. However, with the emergence of the digital world and a younger, tech-based and savvy cohort of investors, gold has transitioned from being solely about jewellery or bank lockers. With the dual benefit of marrying traditions with technology, two new, new-age alternatives, Digital Gold and Gold ETFs, give investors options.

What is Digital Gold?

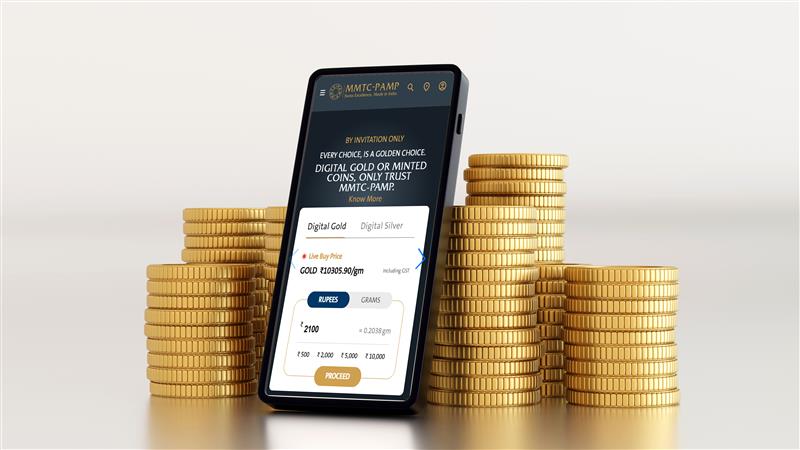

Digital gold is a new and innovative way of purchasing real, physical gold without the hassle of visiting a jeweller or stressing over a secure locker. It allows you to buy an indefinite amount of 24K gold online starting at just ₹1, even just ₹1! The gold that you purchased is stored in insured, locked vaults on your behalf.

You are still the legal owner of the gold, but the provider takes care of the storage and safety. The biggest advantage of digital gold is that the gold purity is assured and verified, so you do not have to worry about going to a jeweller's depot! Digital gold is particularly beneficial to younger investors who prefer the option of doing everything from their phone!

What are Gold ETFs?

Gold Exchange-Traded Funds (ETFs) are investment vehicles that track the price of gold in bullion, rather than physically holding it. Rather than owning and holding physical gold, you buy a unit of a mutual fund whose underlying asset is gold. Gold ETFs are traded on stock exchanges, and you will need a demat account to invest.

While you will not physically hold the gold, your investment represents its value and will generally move with the market price of gold. Since they are backed by regulatory frameworks, Gold ETFs offer transparency, liquidity, and relatively lower transaction costs for those familiar with stock market investments.

Key Differences: Digital Gold vs Gold ETFs

Ownership

Digital Gold: You own actual physical gold stored securely in your name.

Gold ETFs: You own units of a fund that tracks the price of gold, not the gold itself.

Mode of Purchase

Digital Gold: Buy online through apps or websites.

Gold ETFs: Purchase via stock exchanges using a demat account.

Minimum Investment

Digital Gold: Start with as little as ₹1, depending on the platform.

Gold ETFs: The Minimum cost is the price of one unit (roughly 0.5g of gold).

Gold Purity

Digital Gold: Assured 24K, 999.9 gold purity.

Gold ETFs: Backed by high-purity gold, but specific gold purity can vary by fund.

Liquidity

Digital Gold: High liquidity—buy or sell anytime, 24/7.

Gold ETFs: Also, liquid, but only during market hours.

Storage & Security

Digital Gold: Stored in vaults by the provider at no extra cost (usually).

Gold ETFs: No physical storage is needed, as you do not hold any actual gold.

Regulation

Digital Gold: Varies by provider and platform.

Gold ETFs: Regulated by SEBI (Securities and Exchange Board of India).

Delivery Option

Digital Gold: Can be converted into physical coins or bars and delivered.

Gold ETFs: No option for physical gold delivery.

Which One is Right for You?

Choosing between digital gold and gold ETFs depends on your goals and how comfortable you are with financial tools. If you want the peace of mind of owning real gold with verified gold purity, and the ability to convert it into physical gold later, digital gold might be your thing. It's flexible, easy to understand, and great for small, regular purchases.

On the other hand, if you're already investing in the stock market and want a cost-effective, regulated way to track gold prices, gold ETFs make sense. They suit investors who don't need physical delivery and are looking for long-term, low-maintenance exposure to gold in their demat account.

Both options are valid, it just comes down to how involved you want to be and what your comfort level is with online platforms or stock trading.

Tax Implications – Know Before You Buy

Taxes are an important factor in any investment. For digital gold, gains are treated similarly to physical gold. If held for more than three years, profits are considered long-term capital gains and are taxed at 20% with indexation benefits. If sold within three years, gains are added to your income and taxed based on your slab.

Gold ETFs follow a similar taxation structure. The difference is mainly in how the investment is reported; ETFs go into your demat account, so tax reporting is streamlined for those who already file capital market gains.

Either way, you should maintain proper records of transactions to avoid complications during tax filing. Consulting a tax advisor is a good idea, especially if you're dealing with larger amounts.

India's love for gold is timeless. But how we invest in it is changing. With younger investors seeking convenience, safety, and flexibility, both digital gold and gold ETFs offer smart ways to include gold in a modern portfolio. While digital gold appeals to those who value gold purity and tangible ownership, ETFs attract those comfortable with market dynamics and digital portfolios.

The good news? You don't have to choose one forever. Many investors use both, buying digital gold for occasions and flexibility, while keeping ETFs for long-term wealth creation.

No matter the format, one thing is clear: gold continues to shine bright in the Indian investor's journey.

Gold and silver buying has always been personal. It is about festivals, family milestones, quiet savings plans and moments you want to remember. But the way we shop has changed. Today, many people prefer the comfort of browsing online, while still wanting the reassurance of collecting gold or silver in person.

Silver continues to hold strong relevance in Indian households and investment portfolios. It is bought during festive occasions, gifted at weddings and stored as a hedge against uncertainty. At the same time, its growing industrial use in solar panels, electronics, electric vehicles and medical equipment keeps global demand steady.

AML rules affect how gold is bought and recorded, and knowing the basics helps you make safer choices as a gold investor. These regulations make sure KYC is done properly, invoices are clear and transactions are well documented. They also create a more transparent market and protect your ownership records. Understanding these points makes your gold buying journey more secure and organised.

MMTC-PAMP India Private Limited

Rojka-Meo Industrial Estate,

Distt. Nuh,

Haryana – 122103,

India

Ph: +91 124 2868000

CIN - U27100HR2008PTC042218

customercare@mmtcpamp.com

info@mmtcpamp.com

For corporate sales related

queries :

corporate.sales@mmtcpamp.com

Toll Free

1800-313-182182

(08:00 AM - 08:00 PM IST, Mon - Sat)

* Accessible from Indian (+91) numbers only